Tuberculosis Related Grants

Background & Distinctive Features of TB Grants

DSHS Tuberculosis related grants have allocated funds to support the prevention and control of cases through monetary support for biomedical and epidemiologic practices such as testing, diagnosis, directly observed therapy, case investigation, cluster observation, and other services and deliverables as defined by the contractual agreement.

Through Tuberculosis related grants, grantees are required to match no less than 20% of the total budget in contract agreements towards Project-only deliverables and services. No preexisting federal or state funds may be used towards the cash match in the grantee’s budget. These funds must come from existing grantee funds and assets. Failure to provide the set match may cause payment withholdings, administrative offsets, or refund requests of funds by the System Agency (DSHS) until the required match amount is met. Grantee programs must appropriately manage, evaluate, treat, and monitor all patients with suspected or confirmed Tuberculosis, regardless of their jurisdiction and ability to pay.

Specific examples of grant fund use can be

- Tuberculosis prevention and control needs, human resource development, public health laboratory

- Tuberculosis epidemiology

- Active tuberculosis case screenings

- Active tuberculosis treatment

- Contact trace testing of tuberculosis and tuberculosis education and training

According to the Payment Provisions section of the grant, “program income refers to gross income directly generated by a supporting activity during the performance period” that shall be identified and reported in accordance with the Grant Agreement and other guidelines. The grantee must expend all program income during the Grant Agreement term and may not carry the Program income into a succeeding term. For more information regarding the Texas tuberculosis Program Areas, including Health Service Regions and Health District Entities, for financial reporting, please visit the Texas Tuberculosis Work Plan.

ALN Information

*Assistance Listing Numbers (ALN), formerly the Catalog of Federal Domestic Assistance (CFDA).

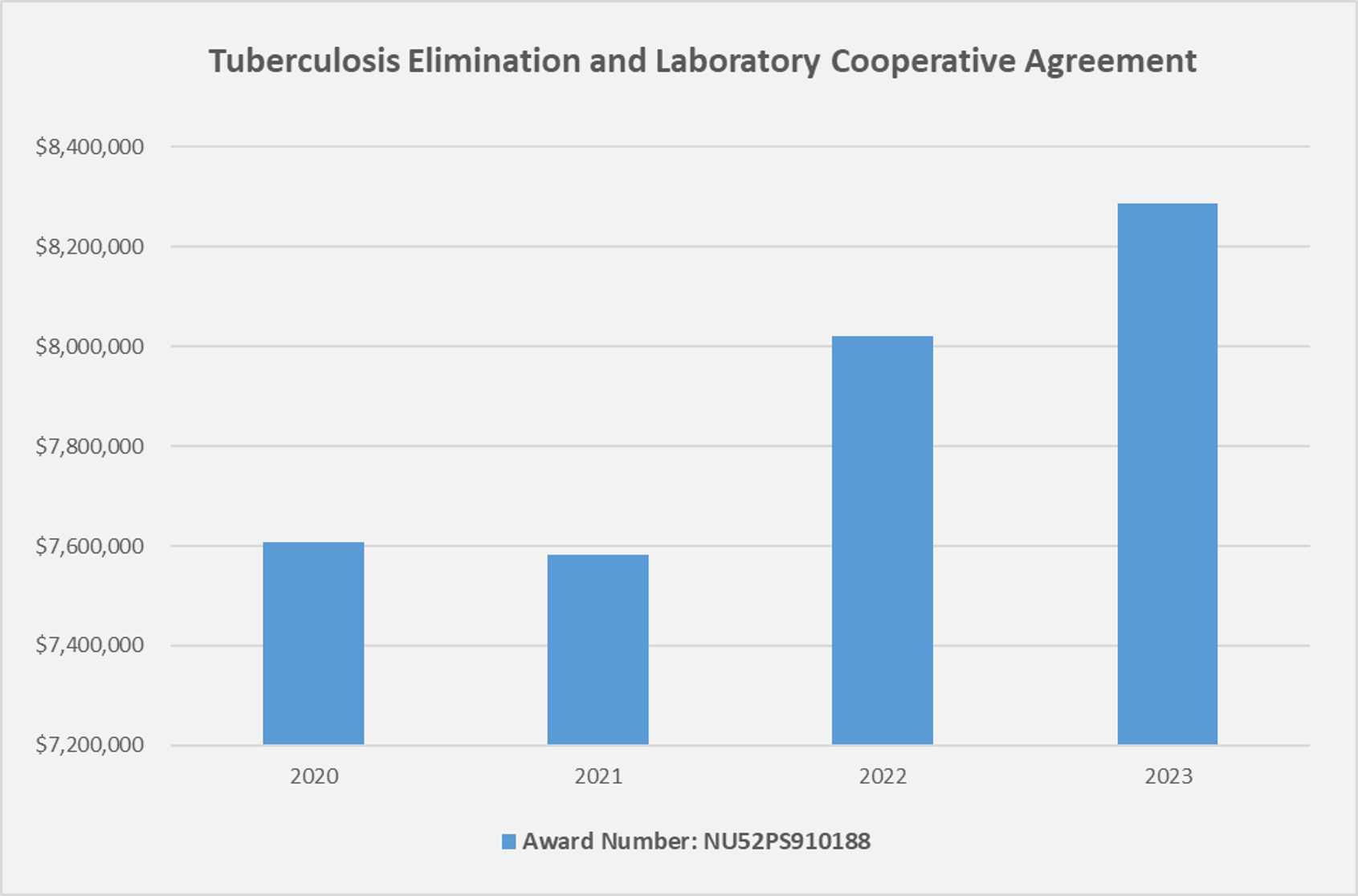

The Centers for Disease Control and Prevention provides federal award funds to assist states, cities, and health districts to prevent and control Tuberculosis spread within these entities. For more information, please refer to More information about Cooperative Agreements for Tuberculosis for objectives and federal funding breakdowns by year.

ALN 93.116 has created opportunity for cooperative agreements and project grants for local and state Tuberculosis (TB) control efforts. These efforts combine the Centers for Disease Control and Prevention (CDC), the Department of Health and Human Services (DHHS), state health departments (e.g., Texas Department of State Health Services), and local health districts. The overarching federal title for this ALN opportunity is “Project Grants and Cooperative for Tuberculosis Control Programs.”

Note: No more than 1% of the total funded amount granted from separate federal and state grants may be used towards TB Prevention and Control. Lapses in federal and state funds can result in a decreased allocation of funds for the next fiscal year. At the beginning of the state fiscal year, grantees should maximize federal funds to ensure lapses do not occur.

Graphs

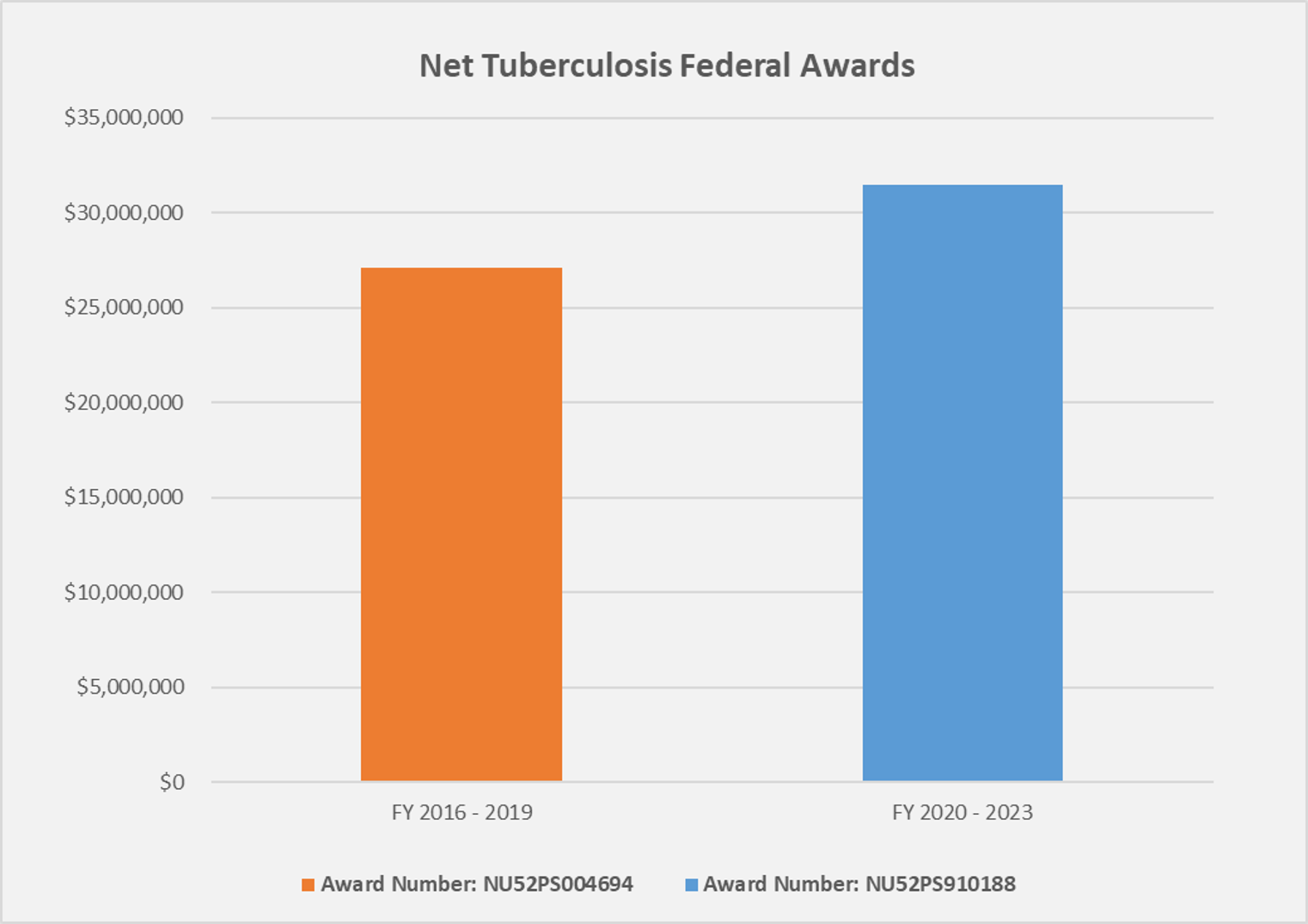

The Texas Department of State Health Services (DSHS) has provided over $58 million dollars in assistance since 2016 to present, split among two prominent federal awards: NU52PS004694 and NU52PS910188.

Requirements

The grantee shall request DSHS payment by prepping an invoice and documents to support reimbursement of services and or deliverables. The grantee must email Financial Status Report 269A (FSR-269A) and Match Certification Form (B-13A) to FSRgrant@dshs.texas.gov and TBContractReporting@dshs.texas.gov. Grantees must email final FSR documents, Match Certification Form, and last reimbursement or final payment request no later than 45 calendar days following the end of the contract. All categorical personnel funds must be expended by the end of the contract period. For more budget monitoring suggestions, please refer to Section XVIII, “Monitor Budget Expenses” of the Texas DSHS TB Work Plan and individual grantee contracts.

Reporting Requirements

| Report Name | Frequency* | Report Email |

|---|---|---|

| Annual Progress Report | Annually | TBContractReporting@dshs.texas.gov |

| Financial Status Report | Quarterly | FSRgrant@dshs.texas.gov AND TBContractReporting@dshs.texas.gov |

| Match Certification Form, B-13A | Annually | FSRgrant@dshs.texas.gov AND TBContractReporting@dshs.texas.gov |

General provisions on reporting requirements:

- Grantee will bill system agency in accordance with grant agreement

- Grantee shall submit requests for reimbursement or payment monthly by last business day following month in which they were incurred

- Grantee shall maintain all documentation that substantiates invoices

If a grantee expends at least $750,000 in federal funds awarded, grantee will have a single audit or program specific audit in accordance with 2 CFR 200, Part F; further information may be found at 2 CFR, Part F, 200.514. If grantee expends at least $750,000 in state funds awarded, grantee will have a single audit or program specific audit in accordance with TxGMS; 2 CFR 200; and Government Audit Standards. Grantees should perform self-audits of program practices to ensure services are aligned with DSHS program standards, grantee contract agreement, and the TB Work plan; and to ensure all supporting documentation is prepared for progress reports, status reports, and match fund certification.

Additional cost principles, audit requirements, and administrative requirements

| Applicable Entity | Applicable Cost Principles | Audit Requirements | Administrative Requirements |

|---|---|---|---|

| State, Local and Tribal Governments | 2 CFR, Part 225 | 2 CFR Part 200, Subpart F and UGMS | 2 CFR Part 200 and UGMS |

| Educational Institutions | 2 CFR, Part 220 | 2 CFR Part 200, Subpart F and UGMS | 2 CFR Part 200 and UGMS |

| Non-Profit Organizations | 2 CFR, Part 230 | 2 CFR Part 200, Subpart F and UGMS | 2 CFR Part 200 and UGMS |

| For-profit Organization other than a hospital and an organization named in OMB Circular A-122 (2 CFR Part, 230) as not subject to that circular | 48 CFR Part 31, Contract Cost Principles Procedures, or uniform cost accounting standards that comply with cost principles acceptable to the federal or state awarding agency | 2 CFR Part 200, Subpart F and UGMS | 2 CFR Part 200 and UGMS |